Roth Ira With Guaranteed Floor

The same combined contribution limit applies to all of your roth and traditional iras.

Roth ira with guaranteed floor. Funding a roth in conjunction with your 401 k provides tax diversification. Variable annuities can offer a wide range of features including a guaranteed death benefit and income for life. It s for one person only. It s simply an account.

It is april 1 of the year following the calendar year in which the original ira owner reached the age to begin taking their mrd. Learn why a roth ira may be a better choice than a traditional ira for some retirement savers. Income segment provides a guaranteed floor of retirement income with a glwb. Your spouse or other family members need to open their own ira if they want that type of retirement account.

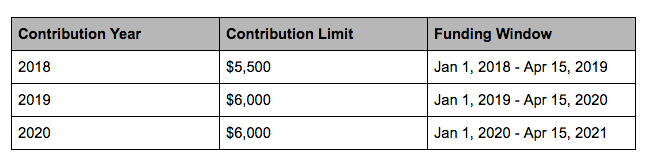

2020 amount of roth ira contributions you can make for 2020. An ira isn t an investment. Your roth ira contribution might be limited based on your filing status and income. In 2019 that limit is.

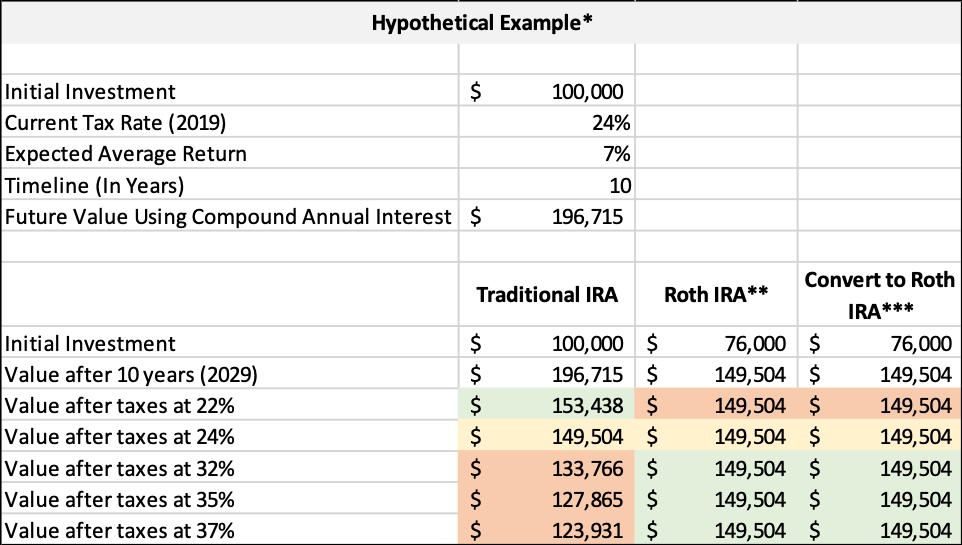

If you satisfy the requirements qualified distributions are tax free. Roth ira roth ira account what is a roth ira. In that account you can hold investments in stocks bonds etfs mutual funds and more. Contributions to a roth ira are non deductible.

Limits on roth ira contributions based on modified agi. There are annual contribution limits. Roth ira for retirement savings. When you combine an annuity with a roth ira the investment can become more attractive.

A roth ira is a retirement savings account that allows you to withdraw your money tax free. The classic 401 k plan offered by most employers provides the same tax benefits as a traditional ira. A roth ira is subject to the rules that apply to a traditional ira except. It may get to keep any of the extra money that you pay it.

You can leave amounts in your roth ira as long. Not apply to roth ira bdas. For roth ira bdas the original ira owner is always treated as dying before rbd. Your income must be below a certain level to qualify and you must have earned an income as opposed to money from pensions investments or properties.

You can make contributions to your roth ira after you reach age 70 if you have eligible earned income. Rbd stands for required beginning date. 2019 amount of roth ira contributions you can make for. A roth ira is also a tool for retirement planning.